Mumbai, 05th August 2024 (GNI): The Initial Public Offering of Ceigall India Limited was subscribed 13.75 times on the final day of bidding despite market in red.

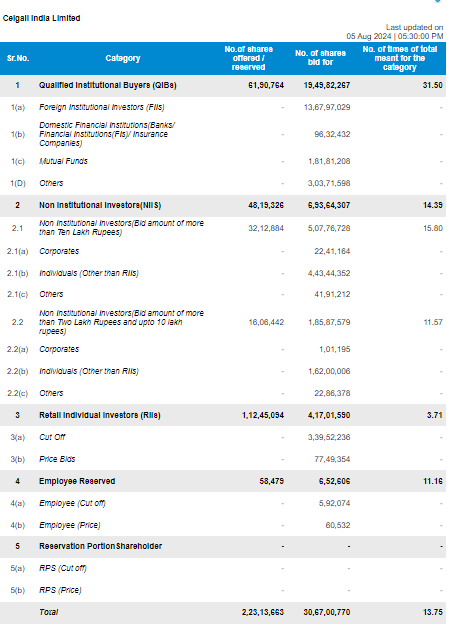

The issue received bids of 30,67,00,770 shares against the offered 2,23,13,663 equity shares, at a price band of ₹380-401, according to the data available on the stock exchanges.

Qualified Institutional Buyer Portion was subscribed 31.50 times. Non-Institutional Investors Portion and Retail Portion were subscribed 14.39 times and 3.71 times respectively, whereas, Employee Portion was subscribed with 11.16 times.

ICICI Securities Limited, IIFL Securities Limited, and JM Financial Limited are the book running lead managers and Link Intime India Private Limited is the registrar to the offer. The equity shares are proposed to be listed on BSE and NSE.

Company Information: Ceigall India is one of the fastest growing engineering, procurement and construction (“EPC”) company in terms of three-year revenue CAGR as of Fiscal 2024, among the companies with a turnover of over ₹ 10,000 million in Fiscal 2024 with over 20 years of experience in the industry. The Company has one of the highest year-on-year revenue growth of approximately 43.10% in Fiscal 2024 among its peers.

The Company has grown at a CAGR of 50.13% between Fiscals 2022 to 2024. Over the last two decades, the Company has transitioned from a small construction company to an established EPC player, demonstrating expertise in the design and construction of various road and highway projects including specialised structures across 10 states in India, according to a CARE Report.

The Ludhiana-based Company’s principal business operations are broadly divided into EPC projects and hybrid annuity model (“HAM”) projects, spread across over ten states in India. As on June 30, 2024, the Company’s Order Book was ₹ 94,708.42 million.

The Company has completed over 34 projects, including 16 EPC, one HAM, five O&M and 12 Item Rate Projects, in the roads and highways sector. Currently, it has 18 ongoing projects, including 13 EPC projects and five HAM projects which includes elevated corridors, bridges, flyovers, rail over-bridges, tunnels, expressway, runway, metro projects and multi-lane highways.

Ceigall India’s revenue from operations increased significantly by 46.48% from ₹ 20,681.68 million in the Fiscal 2023 to ₹ 30,293.52 million in the Fiscal 2024, primarily driven by increase in revenue from construction contracts, and revenue from sale of goods and materials and Finance income on financial assets carried on amortised cost, while the company recorded a significant increase in its profit for the year by ₹ 1,672.72 million in the Fiscal 2023 to ₹ 3,043.07 million in the Fiscal 2024.

The table below shows subscription data for all the categories of investors:

ends GNI

Be the first to comment on "Despite market in red Ceigall India IPO sees 13.75 times subscription"