Monarch Networth Capital announces Rs 300 crore Fund Raise, The round is led by the Promoter, CEO and other marquee investors; Unveils 1:1 Bonus Issue

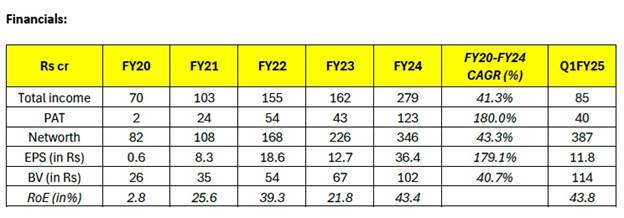

National, 31st July 2024 (GNI): Monarch Networth Capital Ltd., an integrated financial services firm listed on both stock exchanges, announces a strategic fund raise and issue of bonus share following a decisive board meeting. In a landmark move, the company is pleased to secure an equity fund raise of Rs. 300 crores at Rs. 560 per share through preferential allotment. The board has approved a 1:1 bonus issue of shares for its investors. The company’s net profit has soared from Rs. 2 crores in FY-20 to Rs. 123 crores in FY-24 which signifies the company’s unwavering commitment towards growth.

This significant infusion is championed by Promoter group entity Monarch Infraparks Private Limited (Rs.99 cr) and the company’s CEO Gaurav Bhandari (Rs.25 cr), underscoring their unwavering commitment and confidence in the company’s ambitious growth trajectory. The enthusiastic participation from marquee investors is a testament to the robust strategic vision driving Monarch Networth forward.

As a part of the ongoing commitment to strategic governance enhancements, the board has approved the appointment of MSKA & Associates as the auditor of the company, subject to shareholders’ approval in the upcoming AGM. Under the guidance of industry veterans holding rich professional backgrounds, the company aims to further strengthen the board.

The newly secured funds will serve as a catalyst for strategic initiatives across Monarch Networth’s diverse business verticals. The plans include the launch of a PMS offering, scaling the Margin Trading book, launching a Pre IPO fund, applying for a Mutual Fund license, strengthening the Debt Capital Market division, underwriting IPOs, and more. These initiatives are designed to propel the company towards a future brimming with possibilities and promise.

Speaking on the announcement, Mr. Gaurav Bhandari, CEO, MNCL said, “This is a pivotal moment in Monarch Networth’s journey. The overwhelming support from our investors reflects their confidence in our vision and our strategic direction. This fundraise will empower us to accelerate our growth initiatives, innovate our offerings, and continue delivering exceptional value to our stakeholders. At Monarch Networth, where value creation begins, we are committed to transforming every investment into substantial benefits for our clients, partners, and community. Together, we are not just building a company; we are shaping a legacy of excellence and innovation in the financial services industry.”

Mr. Vaibhav Shah, Managing Director, MNCL, said, “This fundraise marks a new chapter in our evolution. It reinforces the trust and belief that our investors have in our strategic vision and operational excellence. The issue of 1:1 bonus shares is a gesture to showcase our gratitude and commitment to rewarding our investors’ enduring belief in Monarch Networth’s immense potential. The fresh capital will enable us to explore new avenues and enhance our service offerings. With this fund raise, our net worth is set to surge to Rs. 700 crore by September 30, 2024. 45% of our employees hold ESOPs in the company, demonstrating our commitment to creating meaningful value for our employees in a real sense. By fostering a culture of entrepreneurship, we are not just building a company; we are empowering our people to share in our success.”

About Monarch Networth Capital Ltd. (MNCL): Since 2019, Monarch Networth has embarked on an extraordinary journey of transformation. The company has evolved from a traditional offline retail broking firm into a vibrant, fully integrated financial services powerhouse. Our strategic expansion into new realms such as Investment Banking, Alternative Investment Funds (AUM now at Rs 1000 cr), Institutional research, Debt Capital Markets, and Wealth Management has been nothing short of remarkable. The firm is present in 100+ cities with 55+ branches across the country and also has a sub-broker network of 900+.

Monarch Networth Capital Limited promoters and CEO have infused Rs. 125 crore (CEO infused Rs. 25 crore in this fund raise). Other marquee institutional investors and family offices included investors such as Aachal Bakheri – Symphony – Rs. 25 crore; Cello promoter – Rs. 20 crore; Century Ply promoter – Sajjan Bhajranka ji – Rs. 10 crore; Madhu Kela – Singularity – Rs. 15 crore; Alembic promoter – Pranav Amin; and marquee investor – Jyothy Sonthalia; Goldiam promoter – Rakessh Bansali, Anand Jain ex Reliance and Jai Corp promoter among other. Ends GNI

Be the first to comment on "Monarch Networth Capital announced Rs 300 crore Fund Raise, The round is led by the Promoter, CEO and other marquee investors; Unveils 1:1 Bonus Issue"