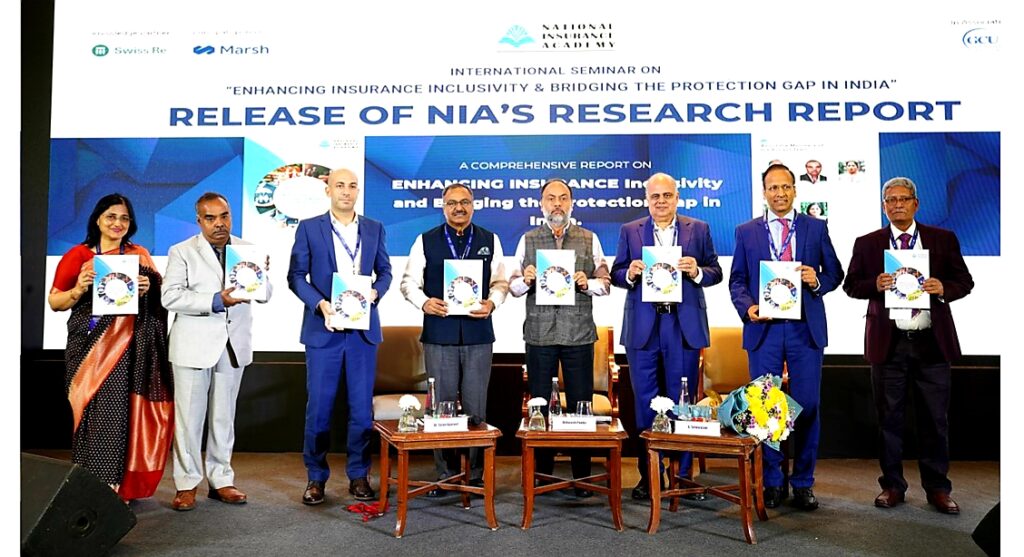

Mumbai, 14th December 2023 (GNI): L-R: Dr. Shalini Pathak Tiwari, Associate Professor, National Insurance Academy; Dr. Steward Doss, Professor, National Insurance Academy; Mr. Hadi Riachi, Market Head, Swiss Re, India; Dr. Tarun Agarwal, Director, National Insurance Academy; Mr. Debasish Panda, Chairperson, Insurance Regulatory and Development Authority of India; Mr. G Srinivasan, ex- Director, NIA, Member, Global Strategic Board, Agam Capital; Mr. Sanjay Kedia, CEO, Marsh McLennan India, President & CEO, Marsh India; Mr. Barun Kumar Khan, Faculty Member, National Insurance Academy at Hotel Taj Lands’ End in Bandra, Mumbai – Photo by Sumant Gajinkar GNI

National Insurance Academy suggests mandatory NAT CAT Insurance in high-risk regions, unveils alarming 95% protection gap in India

- Report reveals a combined 84% of individuals from low- and middle-income categories, and 77% of customers from coastal regions, tier-2, and tier-3 cities, lack property insurance

- NIA suggests compulsory crop insurance for loanee farmers, supported by premium financing from microfinance institutions and agri-input suppliers.

- Highlights Current Annuity and Pension Protection Gap at 93%, with slight urban-rural disparity (91% in urban, 96% in rural)

Mumbai, December 14th, 2023 (GNI): On December 14th, 2023, the National Insurance Academy (NIA), a premier institution dedicated to education, research, and development in Management, Insurance, Pension, and allied fields, organized an international seminar on the theme of “Enhancing Insurance Inclusivity & Bridging the Protection Gap in India” at Hotel Taj Lands’ End in Bandra, Mumbai.

The seminar commenced with a welcome address by Dr. Tarun Agarwal, Director of NIA. In his speech, Dr Agrawal stated, “Through our comprehensive research findings on the protection gap in India, we have tried our best to highlight the way forward, revealing not only the challenges but also the opportunities to safeguard the aspirations of millions. In the realm of insurance, bridging the protection gap is not only necessary but it is also a testament to our commitment to fortify the foundations of financial security for every individual. Alongside Viksit Bharat@2047, it’s time to ensure Insurance for All by 2047 as well.”

Taking centre stage, Mr. Debashish Panda, Chairperson, IRDAI, delivered the keynote address and set the tone for the event.

Renowned international speakers, including Mr. Olivier Mahul from the World Bank, Dr. Kai-Uwe Schanz from the Geneva Association, Mr. Lesley Ndlovu from African Risk Capacity Ltd., Mr. Vijay Kalavakonda from the International Finance Corporation, Prof. W. Jean Kwon from St. John’s University, Prof. Peter Jones, and Dr. Madhusudan Acharyya, both from Glasgow Caledonian University, shared insights on their experiences and learnings on addressing the protection gap with the attendees.

CEOs and top management officials from esteemed organizations, such as Mr. Hadi Riachi from Swiss Re India, Mr. Mayank Bathwal from Aditya Birla Health Insurance Co. Ltd., Mr. Dinesh Pant from LIC of India, Mr. Sanjay Kedia from Marsh McLennan India, Ms. Preeti Chandrashekhar from Mercer Consulting, Ms. Nymphea Batra from Guy Carpenter India, Dr. Kolli N Rao from Aon, and Mr. G. Srinivasan from Agam Capital, also shared their perspectives.

A key highlight of the Seminar was the unveiling of NIA’s research report on Enhancing Insurance Inclusivity & and Bridging the Protection Gap in India. The research team comprising, Dr. Steward Doss, Ms. Jayashree Sridhar, Mr. Barun Kumar Khan, and Dr. Shalini Pathak Tiwari under the guidance of Mr G Srinivasan conducted this extensive research involving pan India survey of 4,755 insured and uninsured customers across different cities, including metro cities, urban areas from Tier I to II and Tier IV-VI from rural areas in addition to corporate entities On behalf of the team, a presentation of critical findings and recommendations was made by Dr Doss and Mrs Jayashree.

Key findings of the research report:

Life Insurance:

- 87% protection gap in life insurance presents business opportunity for life insurers in India, reaching a premium volume of US$106.8 billion by 2030.

Health Insurance:

- Health protection gap stands at 73%. Collaboration between the government, NGOs, and industry groups is crucial to create micro health insurance with simplified products, addressing the significant gap as 31% of India’s population lacks health insurance due to low penetration and coverage inadequacy.

Pension and Annuity:

- Pension coverage lags, with just 24% enrolled in employee retirement schemes. Notably, low-income individuals and lower-middle-income segments exhibit a meagre 14% and 25% penetration, respectively.

Property Insurance:

- Swiss Re’s report (2022) reveals that over 90% of disaster risk losses are unprotected.

- Munich Re’s report (2021) shows nearly 91% of Nat Cat losses are triggered by weather-related perils, increasing volatility and reinsurance complexities.

- Over 80% of upper-middle and high-income customers lack a perceived need for property insurance.

- More than 60% of corporate customers demand Climate Risk Insurance.

Cyber Insurance:

- Cyber protection gap is rapidly expanding across sectors due to increased exposure, higher digital usage, and growing connectivity. 62% of customers want to protect their cyber risk through cyber insurance.

Crop Insurance:

- The insured area and sum insured for crop insurance in India have decreased, accompanied by decline in the number of insured farmers in recent years. However, the insured area as well as the enrolment of farmers are expected to go up in the coming years with various reform initiatives from the government over last few years with strong digital adoption in the entire agri-value chain, increased farmers outreach and capacity building campaigns, and also expansion of new channels like enrolment through India Post and Mobile applications, etc.

Expressing his thoughts on the launch of the report, Dr. S. Doss, Professor, NIA, opined, “Today marks a significant milestone as we launch the research report on the insurance protection gap in India. Our findings highlight the nuanced dynamics of risk and resilience, providing a direction for policymakers, insurers, and the public alike. We are looking forward to taking the responsibility to turn insights into action, closing the protection gap and ensuring that every individual in India has the opportunity to build a secure and resilient future.”

For the event, Glasgow Caledonian University (GCU), UK, was the academic partner, Marsh India Insurance Brokers was the principal sponsor, and Swiss Re was the knowledge partner.

The event served as a platform for industry leaders, stakeholders, and professionals to discuss the various reasons for the insurance protection gap and develop appropriate strategies to reach the unreached segment which can be undertaken through innovative risk and mitigation solutions. For instance, on the distribution front, the report pointed out that there is still substantial work to be done to explore innovative channels beyond traditional avenues. Leveraging an Integrated Technological Architecture, in conjunction with existing infrastructures like microfinance institution networks, NGOs, banking networks (Jandhan), postal networks, CSC, and web aggregators, could substantially narrow the protection gap.

About National Insurance Academy: National Insurance Academy (NIA) was established in 1980 and has since become a preeminent centre for executive training, research and study in the fields of management, insurance, pensions, and related disciplines across India, Africa, and the Middle East, and Southeast Asia. It is widely recognized as a go-to resource by international businesses and organisations from over 60 nations in the areas of human resource development, problem-solving, strategic decision-making, regulatory analysis, and policy planning. Nestled in a lush green scenic estate in Pune- India, the academy has a world-class infrastructure offering tranquillity and a stimulating learning environment at the same time.

Guided by an esteemed governing board, NIA conducts around 250 executive development programs annually, benefiting about 8,000 industry professionals. It is a preferred choice for aspiring talent, offering a two-year AICTE-approved Post Graduate Diploma in Management program, accredited by NBA and MBA equivalent as per AIU standards. NIA maintains a 100% student placement rate, serving as a prominent source of fresh talent for the insurance industry. Through strategic collaborations with national and international institutions, NIA continues to provide tailored solutions, enhancing its global reputation for excellence.ends GNI

Be the first to comment on "National Insurance Academy suggests mandatory NAT CAT Insurance in high-risk regions, unveils alarming 95% protection gap in India"