Mumbai, 18th August 2023 (GNI): GFF Press Conference Panellists [from left to right]: Mihir Gandhi, Senior Vice President Marketing, YES BANK; Mr. Srinivasu MN, Cofounder, Billdesk; Mr. Naveen Surya, Organiser and Advisory Board Member, GFF 2023 and Chairman, Fintech Convergence Council (FCC); G Padmanabhan, Former Executive Director, Reserve Bank of India, Ex-Chairman, Bank of India and Advisory Board Member, Global Fintech Fest 2023; Ms. Praveena Rai, Chief Operating Officer, National Payments Corporation of India (NPCI); Mr. Srinivas Jain, Executive Director & Head of Strategy, SBI Mutual Fund and Advisory Board Member, Global Fintech Fest 2023; Mr. Yashoraj Erande, Managing Director & Partner, Boston Consulting Group during the press conference in Mumbai – Photo by Sumant Gajinkar GNI

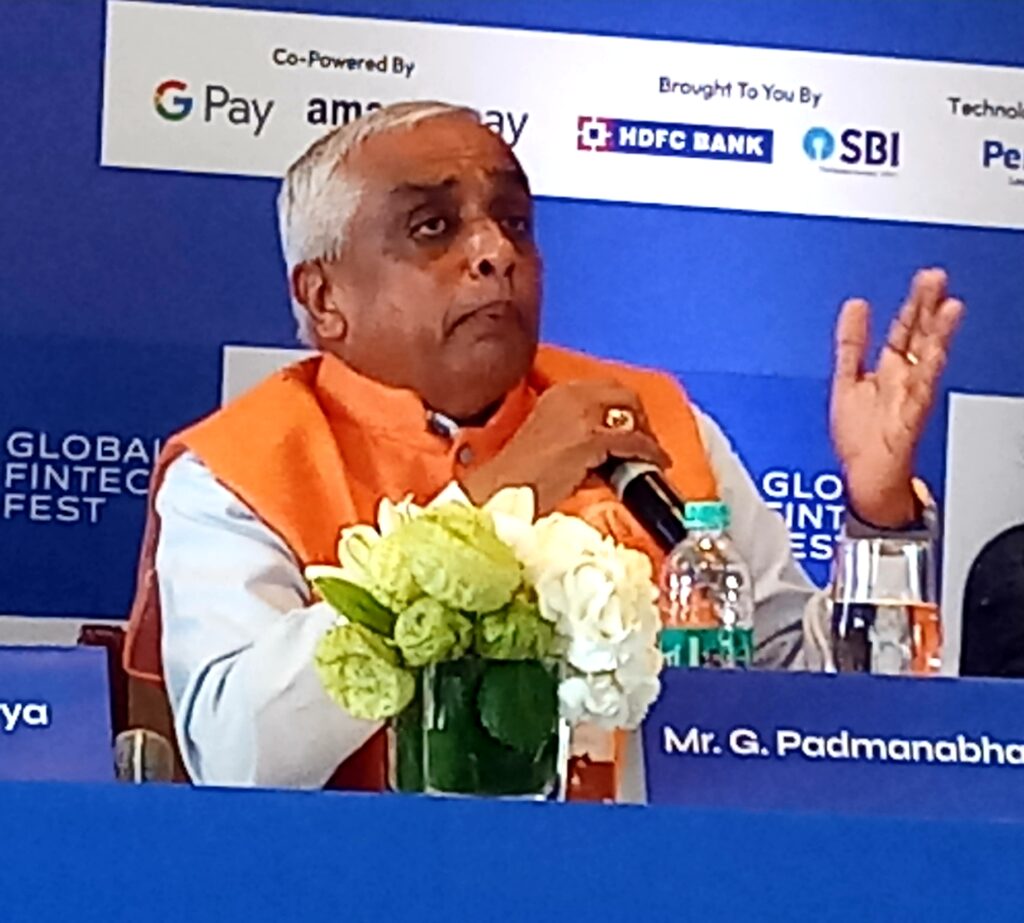

Mumbai, 18th August 2023 (GNI): G Padmanabhan, Former Executive Director, Reserve Bank of India, Ex-Chairman, Bank of India and Advisory Board Member, Global Fintech Fest 2023 addressing the press conference in Mumbai – photo by Sumant Gajinkar GNI

Mumbai, August 18, 2023 (GNI): The Global Fintech Fest (GFF), emerging as the world’s largest fintech conference, is back with its second physical edition. GFF 2023 is scheduled on September 5 – 7, 2023, at the Jio World Convention Centre, Mumbai. The theme of this year’s conference is ‘Global Collaboration for a Responsible Financial Ecosystem: Inclusive | Resilient | Sustainable’.

GFF 2023 is supported by the Ministry of Electronics and Information Technology (MietY), the Department of Economic Affairs (DEA), Ministry of Finance, the Reserve Bank of India (RBI), and the International Financial Services Centres Authority (IFSCA) and is organized by the Payments Council of India (PCI), Fintech Convergence Council (FCC), and National Payments Corporation of India (NPCI).

Among the leading international agencies which are partnering with GFF 2023 are the World Bank, the Global Knowledge Partnership on Migration and Development (KNOMAD), the Consultative Group to Assist the Poor (CGAP), and Women’s World Banking. Australia, Brazil, Great Britain, Germany and Israel are the Country Partners of GFF 2023.

Among stalwarts from India who will share their insights at the GFF 2023 are Smt. Nirmala Sitharaman, Minister of Finance, Government of India; Shri Piyush Goyal, Minister for Commerce and Industry, Textiles and Consumer Affairs, Food and Public Distribution, Government of India; Shri Shaktikanta Das, Governor, Reserve Bank of India; Smt. Madhabi Puri Buch, Chairperson, Securities and Exchange Board of India (SEBI);Shri Debasish Panda, Chairperson, Insurance Regulatory and Development Authority of India (IRDAI); Shri K Rajaraman, Chairperson, International Financial Services Centre Authority (IFSCA); Dr. Vivek Joshi, Secretary,Department of Financial Services, Ministry of Finance, Government of India, Shri Dinesh Kumar Khara, Chairman, State Bank of India Mr. Vijay Shekhar Sharma Founder & CEO, Paytm; Mr. Kunal shah Founder, CRED and many other policymakers, regulators and industry captains.

Not only from India, global luminaries from the fintech and finance ecosystem will also converge at GFF 2023. Among them will be: Mr. Maha Prasad Adhikari, Governor, Nepal Rastra Bank; Dr. Maxwell Opoku-Afari, First Deputy Governor, Bank of Ghana; Soraya M Hakuziyaremye Board, Vice-Chairperson and Deputy Governor, National Bank of Rwanda; Mr. Aleksi Grym, Head of Fintech, Bank of Finland; Mr. Eduardo Enrique Torres Llosa Villacorta, General Manager, Central Bank of Peru; H.E. Khaled Al Basias, Director Financial Sector Development, Saudi Central Bank; Ms. Doris Dietze, Head of Division, Federal Ministry of Finance, Germany; Mr. Masaki Bessho, Head of FinTech Centre, Payment & Settlement Systems Department, Bank of Japan; Mr. Andy White, Chief Executive Officer, Australian Payments Network (AusPayNet) and Mr. Thomas Kurian, Chief Executive Officer, Google Cloud.

Highlights of Global Fintech Festival 2023:

3 days | 13 tracks | 800+ Speakers | 15+ Thought Leadership Reports |81 Academic Papers| 50+ Workshops | 125+ Countries | 250+ Sessions | 250+ Investors |500+ exhibitors |150K Sq. Ft Exhibition Area|3 Hackathons| 50000+ Delegates

Explaining the key objective and vision of GFF 2023,Mr. Kris Gopalakrishnan, Chair, Advisory Board, GFF 2023, Chairman Axilor Ventures and Co-founder Infosys, said, “At the Global Fintech Fest 2023, we converge as orchestrators of transformation, bringing together diverse stakeholders onto one platform to engage in discussions and debates concerning the future of the industry. Our vision extends further than just embracing innovation; it encompasses nurturing ingenuity within our startup community, cultivating an environment where every stakeholder can flourish and be part of a journey towards building an ecosystem that fosters growth, inclusivity, and collaborative progress.”

“The Global Fintech Fest has been a testament to the fintech community’s prowess, showcasing success stories and milestones that inspire us all. Our commitment to promoting collaboration, innovation, and growth has never been stronger. Through this platform, we invite industry leaders, startups, and investors to seize networking opportunities and forge partnerships that will define the future of finance. Together, we will embrace cutting-edge technologies, data privacy and cybersecurity as the cornerstones of trust in our evolving landscape,” said Ms. Praveena Rai, Chief Operating Officer, National Payments Corporation of India (NPCI).

Mr. G Padmanabhan, Former Executive Director, Reserve Bank of India, Former Chairman, Bank of India and Advisory Board Member, Global Fintech Fest 2023, underlined how the conference was aligned with India’s economic progress: “Global Fintech Fest 2023 is going to be the most vibrant celebration of the industry’s exponential growth. We aim to create more than just a fintech engine and the event is expected to architect a powerhouse that would propel India towards a $30 trillion developed economy by 2047. In this endeavour, we are committed to establishing a sustainable, inclusive, and affordable ecosystem that serves as the destination of first choice for foreign capital to invest and participate in India’s transformation into a developed nation”

“The fest since its inception has been showcasing breakthroughs and fostering connections that transcend boundaries. In an era where partnerships drive prosperity, this gathering empowers us to pioneer solutions that navigate regulatory complexities, ensuring a nurturing environment for fintech’s growth. As we celebrate women in fintech, in GFF 2023, we acknowledge their pivotal role and strive to amplify their influence. The fest’s interactive workshops offer a first-hand glimpse into fintech’s dynamic landscape, where technology is not just a tool, but a transformative force. We honour exceptional contributions, driving our industry forward, and emphasize that data privacy, cybersecurity, and trust aren’t just buzzwords – they’re the foundations of fintech’s future,” said Mr. Srinivas Jain, Executive Director & Head of Strategy, SBI Mutual Fund and Advisory Board Member, Global Fintech Fest 2023.

Mr. Naveen Surya, Organiser and Advisory Board Member, GFF 2023 and Chairman, Fintech Convergence Council said, “India has proven its leadership in the international fintech landscape by being the 3rd largest ecosystem in the world. As our country gears up to move up to the largest top three economies, the fintech ecosystem would also play an important role and is all geared up for global leadership. Global Fintech Fest 2023 is our effort towards setting up India as the largest thought leadership platform and collaborating with the world and also fostering responsible innovation. We are looking forward to working with the global fintech ecosystem and delivering a future-proof model suitable for the two third of the financially excluded population across the globe.”

While PricewaterhouseCoopers (PwC) is the Knowledge Partner of GFF 2023, the Boston Consulting Group (BCG) is the thought leadership partner.

Global Fintech Fest 2023 will witness policymakers, regulators, administrators, and industry leaders from India and around the world engaging in invigorating discussions on fostering extensive collaboration for a robust and resilient financial ecosystem.

Also instituted under the GFF 2023 are the Global Fintech Awards (GFA), which honour and celebrate the success of fintech companies worldwide. GFA recognize outstanding emerging start-ups, disruptive technologies, unique business models and innovative founders and entrepreneurs across the globe. Fintech companies, financial institutions and start-ups can nominate their works for Fintech Awards in 21 diverse subcategories under 3 classifications.

For more information on the conference, live agenda and list of speakers visit the website: Global Fintech Fest 2023

About Payments Council of India (PCI): The Payments Council of India (PCI) was formed in 2013 catering to the needs of the digital payment industry. The Council was formed inter-alia for the purposes of representing the various regulated non-banking payment industry players, to address and help resolve various industry-level issues and barriers which require discussion and action. The council works with all its members to promote payments industry growth and to support our national goal of ‘Less Cash Society’ and ‘Growth of Financial Inclusion’ which is also the vision shared by the RBI and Government of India. PCI works closely with the regulators i.e. Reserve Bank of India (RBI), Finance Ministry and similar government, departments, bodies or institutions to make ‘India a less cash society’.

About Fintech Convergence Council (FCC): Setup in 2017 as a fintech committee, Fintech Convergence Council was later converted into an independent council with an independent governing board, with over 70 members. The FCC Represents various players in the Fintech, banking, financial services, and technology space. The FCC works towards the penetration of financial services with the aim of financial inclusion and moving towards a digitally empowered country. It creates opportunities for collaboration and convergence among various players in the financial services domain. Committees under FCC are Lending, Wealth Management, Insurance, Neo-Banking and Regtech.ends GNI

Be the first to comment on "Global Fintech Fest 2023 Set to Emerge as World’s Largest Thought Leadership Platform"