Mumbai, 19th July 2023 (GNI): Ajay Manglunia, MD & Head, Investment Grade Group, JM Financial Ltd, Sanseep Kumar ED, Power Finance Corp, Ltd, Smt. Perminder Chopra, D(Finance) & ADDL. Charge (CMD), Power Finance Corp. Ltd. Sanjay Meherotra, ED, Power Finance Corp Ltd. Pranav Inamdar, Director, Power Finance Corp. Ltd.& with other officials during the press conference in Mumbai – photo by Sumant Gajinkar GNI

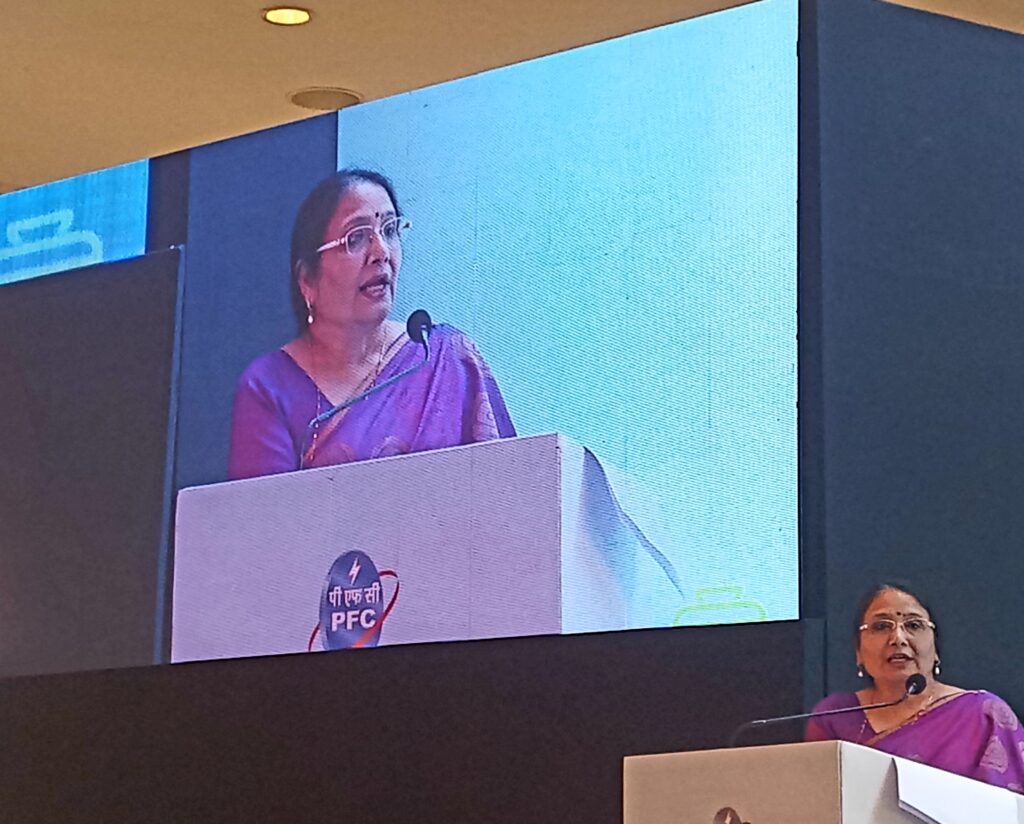

Mumbai, 19th July 2023 (GNI): Smt. Parminder Chopra, Director (Finance) and Additional Charge Chairman and Managing Director addressing to the media during press conferece in Mumbai – photo by Sumant Gajinkar GNI

Public Issue of secured, rated, listed, redeemable, non-convertible debentures (NCDs) of face value of Rs. 1,000 each

The Tranche I Issue of NCDs is for a Base Issue Size of Rs. 500 crore with a green shoe option of up to Rs. 4,500 crore aggregating up to Rs. 5,000 crore, which is within the shelf limit of Rs. 10,000 crore

NCDs are rated as CARE AAA/Stable by CARE Ratings Limited, CRISIL AAA/Stable by CRISIL Limited and ICRA AAA by ICRA Limited

Coupon Rate up to 7.55% p.a. #

Tranche I NCD Issue opens on July 21, 2023, and closes on July 28, 2023 with an option of early closure or extension

The NCDs are proposed to be listed on BSE Limited (“BSE”) (“Stock Exchange). BSE is the designated stock exchange for the Tranche I Issue

Applicable for NCDs (for Category III & IV Investors) series III with the tenor of 15 years, for further details please refer to chapter titled ‘Issue Structure’ on page 70 of the Tranche I Prospectus dated July 17, 2023.

Mumbai/New Delhi, July 19, 2023:(GNI): Power Finance Corporation, is one of India’s leading public financial institution and a Schedule-A Maharatna Central Public Sector Enterprises (CPSE), focused on the power sector, has filed tranche I prospectus dated July 17, 2023 (“Tranche I Prospectus”) for public issue of secured, rated, listed, redeemable, non-convertible debentures of the face value of Rs. 1,000 each. The base issue size is Rs. 500 crore with a green shoe option of up to Rs. 4,500 crore, aggregating up to Rs. 5,000 crore (“Tranche I Issue”), which is within the shelf limit of Rs. 10,000 crore (“Issue”).

The Tranche I Issue opens on Friday, July 21, 2023, and closes on Friday, July 28, 2023 with an option of early closure or extension in compliance with Securities and Exchange Board of India Issue and listing of (Non-Convertible Securities) Regulations 2021, as amended (“SEBI NCS Regulations”). The NCDs are proposed to be listed on BSE Limited (“BSE”), with BSE being the Designated Stock Exchange for the Issue. The NCDs have been rated by CARE AAA/Stable by CARE Ratings Limited, CRISIL AAA/Stable by CRISIL Limited and ICRA AAA (Stable) by ICRA Limited.

The minimum application size would be Rs. 10,000 (i.e. 10 NCDs) and thereafter in multiples of Rs. 1,000 (i.e. 1 NCD) thereof. This issue has maturity / tenure options of 3 years, 10 years and 15 years for NCDs with annual coupon payment being offered across series I, II, and III, respectively. Effective yield for NCD holders in various categories ranges from 7.44% to 7.54% per annum.

Out of the net proceeds of the Tranche I Issue, at least 75% shall be utilised for the purpose of onward lending, financing / refinancing the existing indebtedness of the company, and /or debt servicing (payment of interest and/or repayment / prepayment of interest and principal of existing borrowings of the Company) and a maximum up to 25% will be utilised for general corporate purposes.

For the fiscal year 2023, the company’s consolidated revenue from operations stood at Rs 77,568.30 crore against Rs 76,261.66 crore a year ago on the back on increase in interest income on loans and other operating income. Consolidated Net profit for the FY23 was Rs 21,178.59 crore as against Rs 18,768.21 crore last year.

JM Financial Limited, A.K.Capital Services Limited, Nuvama Wealth Management Limited, SMC Capitals Limited, and Trust Investment Advisors Private Limited are the lead managers to the Issue (“Lead Managers”). Beacon Trusteeship Limited is the Debenture Trustee to the Issue and KFin Technologies Limited is the Registrar to the Issue.

Please note that the allotment under Tranche I Issue will be on the basis of the date of upload of each application into the electronic book of the Stock Exchange in accordance with the SEBI Master Circular. However, from the date of oversubscription and thereafter, the allotments will be made to the applicants on a proportionate basis. For further details, refer section titled “Issue Procedure” on page 98 of the Tranche I Prospectus dated July 17, 2023.

About Power Finance Corporation Limited::

Power Finance Corporation is a publicly listed Government of India (GoI) undertaking and operates as a public financial institution as defined under the Companies Act of 2013. Registered with the Reserve Bank of India (RBI) as a non-deposit taking systemically important Non-Banking Financial Company (NBFC), it obtained the classification of an Infrastructure Finance Company (IFC) on July 28, 2010. The Company believes that its NBFC and IFC classifications enables it to effectively capitalize on available financing opportunities in the Indian power sector.ends GNI

Be the first to comment on "Power Finance Corporation Limited announced to tap Capital Market to raise upto Rs 5,000 crore via public issue of Secured NCDs"