Key Highlights:

- The Omicron-led third wave of Covid-19 pandemic has resulted in resurgence in fresh Covid-19 infections leading to restrictions by various state governments impacting the trading values for the retail store operators and hindering the rental recovery for mall operators

- The trading values are expected to decline to 60-70% of pre-Covid levels in Q4FY2022 due to third wave as against recovery of over 85% in Q3FY2022

- With the estimated rental recoveries over 85% of pre-covid level, Q3FY2022 was the best quarter for the mall operators since onset of the pandemic

- With 20-25% reduction in rentals in Q4FY2022, the malls would again be reliant to some extent on available bank balances and undrawn lines, in the absence of which timely sponsor support will be critical

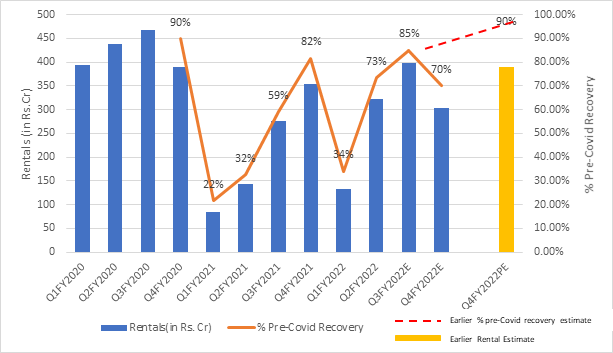

- With impact on recovery in Q4FY2022, the rental recovery for FY2022 is expected to be up to 70% of pre-Covid levels, as compared to earlier estimates of up to 75% recovery

- Overall, majority of the store categories are expected to reach near-normalcy by Q1FY2023 as against earlier estimated Q4FY2022 with variance depending on the mall or brand specific factors

Mumbai, 25th January 2022 (GNI): The Omicron-led third wave of Covid-19 pandemic has resulted in resurgence in fresh Covid-19 infections leading to restrictions by various state governments impacting the trading values for the retail store operators and hindering the rental recovery for mall operators. The footfalls in the malls are witnessing a declining trend from the first week of January 2022 with restrictions in major cities such as closing dine-in for restaurants, occupancy restrictions for multiplexes and their closure in few cities along with weekend curfews. This is sure to impact the rental recoveries for Q4 FY2022 and thereby FY2022.

Commenting on this further, Ms. Anupama Reddy, Sector Head, Corporate Ratings, ICRA, says “The trading values are expected to decline to 60-70% of pre-Covid levels in Q4FY2022 due to third wave as against recovery of over 85% in Q3FY2022.The rental recovery for Q4FY2022 is estimated to be at 70%[1] of pre-Covid levels as against the earlier estimates of over 90% levels. Also, the rental recovery for FY2022 is expected to be up to 70% of pre-Covid levels, as compared to earlier estimates of up to 75% recovery. However, the recovery post third wave is expected to be faster than the previous waves with short tenured restrictions and expected quick ramp up for major tenant – multiplexes, as content line up remains robust with several big budget movies ready for release.”

Exhibit 1: Trends in rental recovery for ICRA’s sample

With the estimated rental recoveries over 85% of pre-covid level, Q3FY2022 was the best quarter for the mall operators since onset of the pandemic. The recovery was driven by pent-up demand, high vaccination coverage, resumption of multiplexes which also coincided with the festive season.

While certain store categories such as hypermarkets, electronics and fashion and beauty have done extremely well with certain brands even exceeding the pre-Covid sales, tenants such as department stores and food and beverage are observed to have moderate recovery in line with the improvement in footfalls in Q3FY2022. The trading values for these stores would be impacted by the third wave in Q4FY2022. Multiplexes will be the most impacted segment due to deferred movie releases.

Overall, majority of the categories are expected to reach near-normalcy by Q1FY2023 as against earlier estimated Q4FY2022 with variance depending on the mall or brand specific factors.

Commenting on debt coverage metrics, Ms. Reddy added, “Weaker H1FY2022 due to second wave and expected reduction in recovery in Q4FY2022 due to third wave of pandemic is expected to impact the full year FY2022 debt coverage metrics. The projected DSCR is estimated to be in the range of 0.70-0.75 times as against earlier estimates of 0.80-0.85 times. The support from sponsors, debt service reserve and undrawn credit lines (for few issuers) have helped ICRA rated malls in meeting their obligations during the H1FY2022. With improvement in rental recoveries, there was no significant shortfall or major dependence on sponsors in Q3FY2022. However, with 20-25% reduction in rentals in Q4FY2022, the malls would again be reliant to some extent on available bank balances and undrawn lines, in the absence of which timely sponsor support will be critical,” stated in the press release.ends

Be the first to comment on "Rentals of mall operators expected to decline by 20-25% in Q4FY2022 as against earlier estimates due to Omicron-led third wave: ICRA"