MUMBAI, 19 NOVEMBER 2024 (GNI) : The Indian Hotels Company Limited (IHCL), India’s largest hospitality company, today announced its comprehensive strategy for 2030. Under the plan, IHCL will expand its brandscape, deliver industry- leading margins, double its Consolidated revenue with a 20% return on capital employed and grow its portfolio to 700+ hotels while building on its world-renowned service ethos.

Mr. Puneet Chhatwal, Managing Director and Chief Executive Officer, IHCL said, “IHCL has surpassed its guidance by achieving a portfolio of 350 hotels, with over 200 hotels in operation and delivered ten consecutive quarters of record financial performance. This strong performance, coupled with a robust balance sheet, positions us well to accelerate our growth momentum. Enabling this vision are long term structural tail winds for the sector including India’s forecasted GDP growth of over 6.5%, government’s continued focus on infrastructure spend, hotel demand outpacing supply and the rising affluence of the consumer base.”

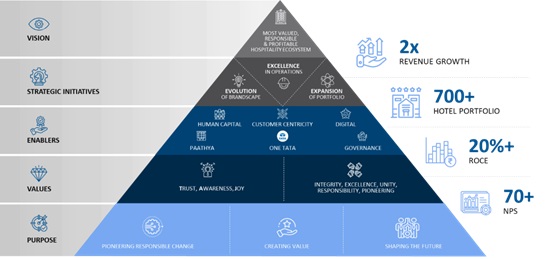

He added, “IHCL remains steadfast in its commitment to realise India’s tourism potential with its vision of ‘Accelerate 2030’, of being the most valued, responsible and profitable hospitality eco-system in South Asia. IHCL will expand its brandscape with the launch of new brands, tapping the heterogenous market landscape and taking its portfolio to 700 hotels by 2030. Doubling its Consolidated revenue to INR 15,000 crores, scaling new and re-imagined businesses to 25%+ share of revenue and continue to generate industry-leading margins and return on investment, while maintaining its renowned service excellence.”

Under ‘Accelerate 2030’, the focus will be on driving top-line growth with 75% from traditional businesses and management fee and 25%+ from new and re-imagined businesses. Traditional businesses will be enabled by RevPAR leadership, asset management initiatives and inventory expansion of existing assets. Management Fee is expected to cross INR 1,000 crores by 2030, led by not like for like growth and increasing share of managed inventory. New Businesses, comprising of Ginger, Qmin, amã Stays & Trails and Tree of Life will rapidly scale through a capital light route, delivering a revenue CAGR of 30%+, while the re-imagined businesses of The Chambers and TajSATS, will continue their growth momentum.

Mr. Ankur Dalwani, Executive Vice President and Chief Financial Officer, IHCL said, “Basis expected strong cash flow generation over the next few years, IHCL will continue to remain net cash positive. Our capital allocation framework envisages investments towards strengthening existing and building future competitive advantages, through an outlay of upto INR 5,000 crores over the next 5 years. This investment is expected to be across existing properties and identified expansion projects. We are also committed to our announced dividend policy of distributing 20% to 40% of PAT to the shareholders leaving sufficient cash balance for future greenfields, accretive inorganic opportunities and strategic cash reserves.”

Evolution of the brandscape will be central to achieving optimum scale, building salience for new and re-imagined brands and introducing innovative formats and concepts. This includes entering new segments like branded residences and extending the brandscape with newer brands like the addition of The Claridges, an opportunity to grow with a differentiated offering in the luxury segment.

Expansion of the portfolio will maintain IHCL’s leadership in the Indian Sub-Continent. International presence will be built in global gateway cities with a focus on capital light route only with the Taj brand. Taj, SeleQtions and Vivanta will continue their steady growth, collectively contributing another 100 hotels to the pipeline. Reflective of the emerging consumer trends as well as the growth in Tier I and II cities, 75% of our new additions will be driven by the boutique leisure offering of Tree of Life, the re-imagined Gateway brand in the upscale segment, Ginger in the midscale segment.

Excellence in operations with industry leading ESG+ framework of Paathya and IHCL’s world-renowned service standards will be the key enablers on this journey.ends GNI

Be the first to comment on "IHCL UNVEILS ‘ACCELERATE 2030’ STRATEGY EXPAND BRANDSCAPE WITH NEW BRANDS AND NEW SEGMENTS"