Mumbai, 07th March 3024 (GNI): The Initial Public Offering of Gopal Snacks Limited was fully subscribed on the second day of bidding.

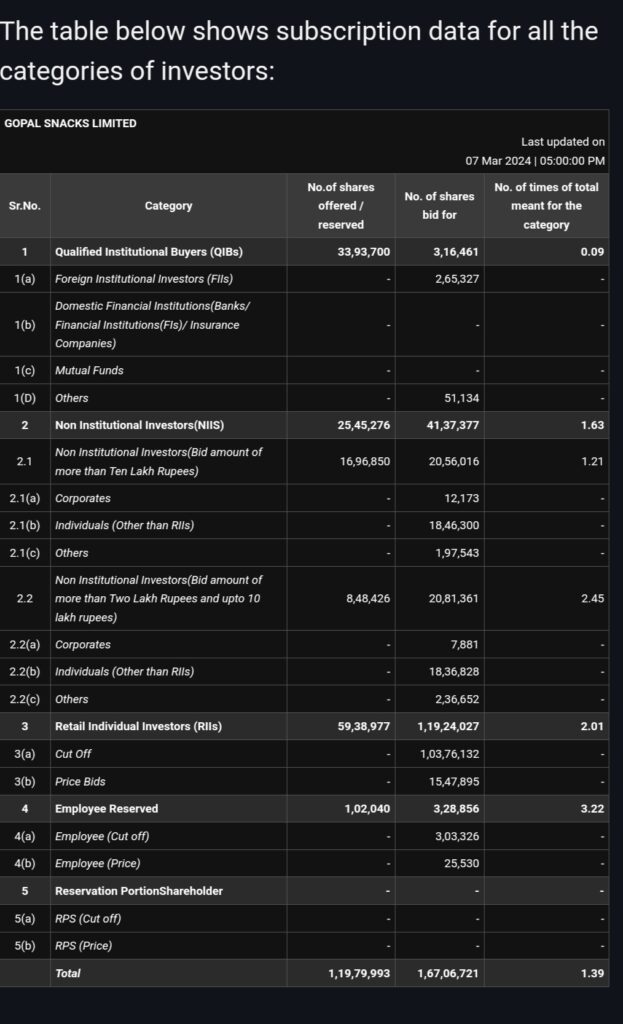

The issue received bids of 1,67,15,971 shares against the offered 1,19,79,993 equity shares, at a price band of ₹381-401, according to the data available on the stock exchanges. Overall the issue was subscribed 1.39 times.

Employee Portion was subscribed 3.22 times. Retail Portion and Non-Institutional Investors Portion was subscribed 2.01 times and 1.63 times respectively, whereas Qualified Institutional Buyer Portion was subscribed 0.09 times. The issue kicked off for subscription on Wednesday, March 06, 2024 and will close on Monday, March 11, 2024.

A day prior to the opening of the issue, Gopal Snacks Ltd had raised Rs 193.94 crores from anchor investors. Foreign and Domestic Institutions who participated in the anchor were Ashoka White Oak, White Oak MF, DSP MF, Quant MF, IIFL Wealth & Asset Management (360 One), Natixis, BNP Paribas, OptiMix Global Emerging Markets Share Trust, Edelweiss MF, HDFC Life Insurance, ITI MF, Leading Light Fund, Bay Capital, BoFA Securities and Copthall Mauritius.

Leading brokerage firms like Anand Rathi, Choice Broking, Dalal & Broacha, Indsec Securities, Mehta Equities, Nirmal Bang, Reliance Securities, Sushil Finance, Swastika Investmart and Ventura Securities have given a “Subscribe” rating to Gopal Snacks Ltd, given its diversified product portfolio, strategically located manufacturing facilities and strong distribution network. GSL is the largest manufacturer of gathiya and the second largest ethnic packer in Gujarat. The company also has a vertically integrated advanced business operations resulting in quality products and cost & operational efficiencies. Going forward the company is planning to expand its presence in focus markets, enhance brand awareness and leverage unutilized capacity and technology to optimize operations.

GSL’s dependence on core products and Gujarat market for its revenue are pointed out as key risks of the company by the brokers.

Intensive Fiscal Services Private Limited, Axis Capital Limited and JM Financial Limited are Book Running Lead Managers to the Offer and Link Intime India Private Limited is the Registrar to the Offer. The Equity Shares are proposed to be listed on BSE and NSE.

Company Information: Gopal Snacks Limited (“Company”) is a fastmoving consumer goods company in offering ethnic snacks, western snacks and other products under our brand ‘Gopal’. It was established as a partnership firm in 1999 and subsequently incorporated as a company in 2009.

The company offer a wide variety of savoury products under the brand ‘Gopal’, including ethnic snacks such as namkeen and gathiya, western snacks such as wafers, extruder snacks and snack pellets, along with fast-moving consumer goods that include papad, spices, gram flour or besan, noodles, rusk and soan papdi which are semi-perishable in nature.

As of September 30, 2023, product portfolio comprised 84 products with 276 SKUs across its various product categories, thereby addressing a wide variety of tastes and preferences. The company have expanded their footprint across India, with their products being sold over 523 locations in ten States and two Union Territories. The Company’s distribution network comprises of three depots and 617 distributors, complemented by its sales and marketing team comprising 741 employees.

BSE+NSE Cumulative Link: https://www.bseindia.com/markets/publicIssues/CummDemandSchedule.aspx?id=6480

ends GNI

Be the first to comment on "Gopal Snacks IPO fully subscribed on Day 2 "