Mumbai, 15th February 2024 (GNI): Pranav Gokhale, Sr. Fund Manager and Shridatta Bhandwaldar, Head Equities, Canara Robeco AMC addressing to the media at the press conference in Mumbai – photo by Sumant Gajinkar GNI

Canara Robeco Mutual Fund focused on the manufacturing sector with its new fund, The NFO opens on 16th February and closes on 1st March 2024

Mumbai, February 15, 2024 (GNI): Canara Robeco Mutual Fund, India’s second oldest mutual fund today announced the launch of Canara Robeco Manufacturing Fund in an attempt to capitalize on India’s potential to become the next manufacturing hub. The fund is an open-ended equity scheme that represents India’s manufacturing theme and will be benchmarked against the S&P BSE India Manufacturing TRI. The NFO, opens on February 16, 2024, and offers a medium to provide a dedicated allocation to the manufacturing sector. The NFO will remain open until March 01, 2024.

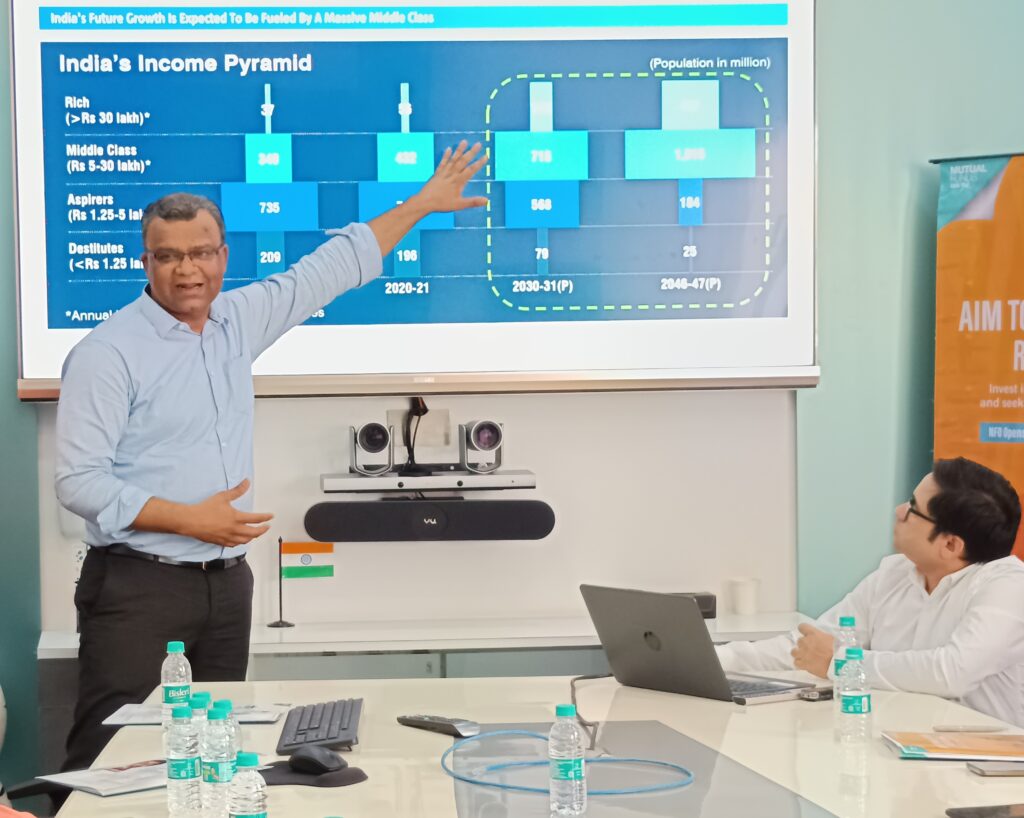

“The Canara Robeco Manufacturing Fund enters the market at a pivotal moment when there is a rising middle class and rising working-age population in India. This fund will be suitable for established investors because of the thriving domestic demand, favourable policy reforms, robust and deleveraged corporate balance sheet and a stable political environment. India seems to be well positioned to become an attractive investment destination. This fund will seek to benefit from policy reforms like Atmanirbhar Bharat, PLI, Make in India, Single Window Clearance and import substitution,” said Rajnish Narula, CEO, Canara Robeco Mutual Fund.

“India is witnessing the confluence of factors which are conducive for the manufacturing scale up. Factors such as, large and growing domestic market, favourable government policies, fiscal support for capex, de-leveraged corporate balance sheets and global supply chain rejig which is allowing Indian manufacturers to participate in export value chain. Import substitution and export ecosystem is likely the outcome of these macro factors.

With this fund, we are providing the investors with the opportunity to become a part of India’s manufacturing growth story. The fund will adopt a growth strategy aiming to capitalize on manufacturing trends and opportunities, investing across relevant sectors, representing the manufacturing theme,” said Shridatta Bhandwaldar, Head Equities, Canara Robeco.

This fund is suitable for investors comfortable with volatility and expecting a better risk-return tradeoff, with a high-risk appetite and a long-term investment horizon of 5 years and above, having lower near-term liquidity needs. The fund will invest minimum 80% into manufacturing & allied stocks, 0-20% in equity and equity-related Instruments of companies other than engaged in manufacturing theme, 0-20% in debt and debt market instruments and 0-10% in units issued by REITs and InvITs. The minimum investment in the fund is Rs. 5,000 and in multiplies of Re. 1 thereafter.

The fund managers for this fund are Pranav Gokhale, Sr. Fund Manager and Shridatta Bhandwaldar, Head Equities, Canara Robeco AMC.

About Canara Robeco Mutual Fund:

Canara Robeco Mutual Fund is the second oldest Mutual Fund in India, established in December 1987 as Canbank Mutual Fund. Subsequently, in 2007, Canara Bank partnered with Robeco (now a part of ORIX Corporation, Japan) and the mutual fund was renamed as Canara Robeco Mutual Fund. The AUM as on 31st January 2024 is INR 85,988 crores. Our solutions offer a range of investment options, including diversified and thematic equity schemes, hybrid and a wide range of debt products.ends GNI

Be the first to comment on "Canara Robeco Mutual Fund focused on the manufacturing sector with its new fund"