Mumbai, 03rd November 2022 (GNI): The US Fed raised its policy rate by 75bps to 3.75-4% yesterday, as was widely expected. In terms of forward guidance, the expectations of any signs of a Fed pivot were squashed. The central bank signalled that it might dial down the pace of rate increases, perhaps as early as December, however the terminal rate is likely to be higher than earlier expected.

- Signals of slower pace of rate hikes ahead: In the policy statement, the Fed outlined a potential change in how it will approach future monetary policy action considering cumulative tightening and policy rate hike lags. The Fed Chair Jerome Powell also said that it might be appropriate to slow the pace of rate increases as early as the next meeting or the one after that.

- But no Fed pivot for now: Powell, in the post policy press conference, said that it is premature to be thinking of a pause and that given incoming data, monetary policy will have to be “sufficiently restrictive” and the terminal rate is likely to be higher than earlier expected. Moreover, Powell signalled that the risks to pausing prematurely are higher than overdoing interest rate hikes – reaffirming the Fed’s hawkish stance.

- Fed rate view: This might be the last 75bps rate hike by the Fed, although the Fed might abstain from putting its guard down on inflation just yet. We expect the US Fed to deliver a 50bps hike in December and see the terminal policy rate around 5% or slightly higher in this cycle.

- Market reaction: The dollar index initially fell on signs of smaller rate hikes ahead in the policy statement but later regained its strength with hawkish comments by Powell in the post policy press conference. The DXY was last trading at 111.94 while Asian currencies were under pressure with the CNY trading at 7.30 against the dollar in early morning trade today. The USD/INR pair was last trading at 82.87 at the time of writing compared to its close of 82.78 yesterday.

- Currency View: The dollar bid remains intact in the near-term as the Fed policy announcement did not offer much good news for the markets. Consequently, the path towards 83.50 or maybe even 84.0 for the USD/INR pair in the near-term remains in place. Over the medium term, we continue to hold on to the view that the dollar bid will gradually fade by early next year as the Fed starts to slow down its pace of rate increases and markets again price in a Fed pivot. This should reduce the dollar’s appeal or atleast put a cap on its peak. In turn we expect this to bring about some stability in the USD/INR pair in Q1 2023.

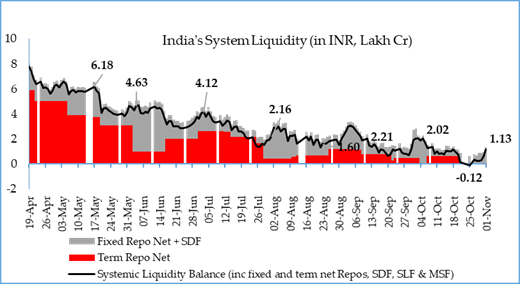

- RBI reaction: While one expects the RBI to continue with its FX interventions to stall free falls in the rupee, it is unlikely to defend any specific levels. On the policy front, the RBI is expected to raise the repo rate to atleast 6.5% or higher as providing a currency defence becomes prominent on the RBI’s agenda. On the liquidity front, conditions are likely to remain tight (with brief periods of liquidity slipping into deficit) and any injection of durable liquidity (beyond any measures under the LAF window including longer term repo operations) – that is viewed as “accommodative” is likely to be difficult to deliver and to justify by the RBI. That said, there could be some natural supports for liquidity conditions as government spending picks up during the second half of the year.

India’s liquidity stood at INR 1.13 lakh crore as of 1st Nov-22

Source: CEIC, HDFC Bank

Markets will look ahead to the BoE policy meeting today (expectation of a 75bps rate hike) and the US labour market data to be released on Friday.

Federal Reserve Meeting – The Details

The Fed delivered its fourth straight 75bps rate hike, taking the Fed Funds rate to 3.75-4.0% yesterday, the highest level since January 2008.

- Fed seen titling towards lesser hawkish statement: The Fed signalled that their aggressive campaign to tame inflation could be approaching its final phase. Fed Chair Powell said that he expects a discussion at the next meeting or two about slowing the pace of tightening. However, he also said that “it is very premature to be thinking about pausing” and “we still have some ways to go and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected”. This implies that Fed rates are likely to peak around 5% or higher by the first half of 2023.

- Key change in the Fed’s statement: The statement now says that the Fed is considering the “cumulative” impact of its rate hikes so far. In a new sentence added in the statement, the Fed said “In determining the pace of future rate increases in the target range, the committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity, and inflation, and economic and financial developments”

- Future rate increases: The probability of a 50bps rate hike at the December policy meeting rose post the Fed policy outcome while probability of a 75bps rate hike fell, as per the CME FedWatch Tool. The market is now expecting a ~62% chance of a 50bps rate hike in the December policy meeting (vs. 44.5% yesterday).

- Impact on the market:

- US Stocks closed in red as the Fed signalled that the Fed is not close to end rate hike cycle. Dow Jones Index closed lower by 1.55% while S&P closed lower by 2.5% yesterday.

- US Yields: 10-year yield closed higher by 1bps while 2Y closed higher by 3bps yesterday after Powell said that rates will go higher than expected.

- Dollar Index: The DXY closed lower by 0.12% to 111.345 yesterday. The DXY is trading stronger at 111.94 (at the time of writing).ends GNI SG

Be the first to comment on "HDFC Bank Treasury Research Desk – Trade View: No pivot, but smaller rate hikes head"