Q3 FY21 Consolidated Performance:

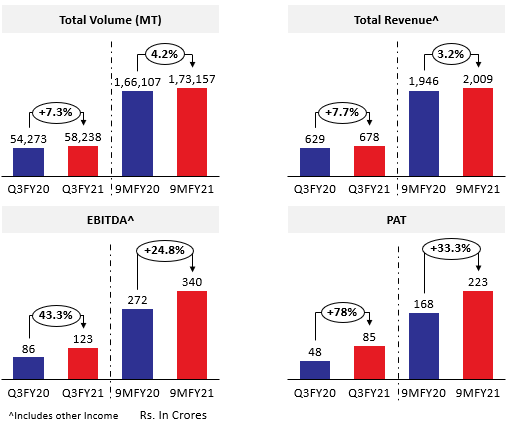

· Total volume grew by 7.3% for Q3FY21, on YoY basis

· Total Revenue (including other income) stood at Rs. 677.7Cr, a YoY growth of 7.7% on account of better sales volumes in both Performance Surfactants and Specialty Care business and better sales mix

· EBITDA stood at Rs. 122.5 Cr, YoY growth of 43.3%; driven by increasing share of specialty, better product mix due to new products and higher capacity utilization

· PAT stood at Rs. 85.2 Cr, YoY growth of 77.6%

· The Board has declared interim dividend of Rs. 14 Per Equity share of Face Value of Rs 10 for the financial year 2020-21

Mumbai, 8th February 2021 (GNI): Galaxy Surfactants Limited, a leading manufacturer of performance surfactants and specialty care products with over 205 product grades used in Home and Personal Care industry, has announced its financial results for the Quarter & Nine Months ended 31st December 2020.

Commenting on the performance Mr. U. Shekhar, Managing Director, Galaxy Surfactants Limited said,

“Today marks the 3rd anniversary since Galaxy surfactants got listed in 2018 and the Q-3 performance adds to this momentous occasion. If Q-2 stood for recovery, Q-3 stands for normalisation, sustenance and resumption of the growth trajectory. The robust momentum of Q-2 has sustained in Q-3. We are pleased to share that Q-3 marks the 1st quarter in FY21 where your company has grown in every area, be it segments, regions or each of the financial parameters we measure ourselves on. This quarter also marks the first in FY21 where our Specialty Portfolio has registered Y-O-Y growth, arresting the underperformance reported in the last few quarters. Demand continues to remain robust for our performance surfactants, thus clearly highlighting the resilience and robustness of your company’s business model. With the vaccination drive gaining traction, opening up of the economies with greater consciousness about health and hygiene should augur well for our performance, masstige as well premium specialty products. While demand continues to remain robust, rising volatility in raw material prices, supply chain disruptions pose the biggest risks in servicing this underlying demand. But, despite the challenges and none bigger than the one seen this year, we remain confident and optimistic about our growth journey,” stated in the press release.

Performance Highlights:

| Galaxy Surfactants Limited (Consolidated Results) | |||||||||

| Particulars (Rs. Cr) | Q3FY21 | Q3FY20 | YoY% | 9MFY21 | 9MFY20 | YoY% | |||

| Total Revenue* | 677.7 | 629.3 | 7.7% | 2,008.8 | 1,945.6 | 3.2% | |||

| EBITDA* | 122.5 | 85.5 | 43.3% | 339.7 | 272.2 | 24.8% | |||

| PAT | 85.2 | 48.0 | 77.6% | 223.5 | 167.6 | 33.3% | |||

| *Includes other income | |||||||||

| Galaxy Surfactants Limited (Volume Break up) | ||

| Particulars | YoY Growth % (Q3FY21 vs Q3FY20) | YoY Growth % (9MFY21 vs 9MFY20) |

| Sales Volume | 7.3% | 4.2% |

| India | 14.4% | 13.2% |

| AMET | 2.9% | 6.3% |

| ROW | 4.3% | -10.1% |

Q3FY21 Performance

· Total volumes stood at 58,238 MT for Q3FY21 as against 54,273 MT in Q3FY20, up by 7.3% YoY

o ROW markets grew by 4.3% due to Specialty Care Products

o Robust Performance by Indian market with a 14.4% growth

o AMET market grew by 2.9% due to recovery in the Egypt market

o Performance Surfactants volume stood at 36,618 MT for Q3FY21, up by 4.7% on YoY basis

o Specialty Care Products volume stood at 21,620 MT for Q3FY21, up by 12.0% on YoY basis

· EBITDA for Q3FY21 stood at Rs. 122.5 Cr as against Rs. 85.5C r in Q3FY20, up by 43.3% YoY basis

o EBITDA includes export incentives realised in Egypt accounted for on receipt basis. Net Incremental Export Incentives included in Q-3 over previous year equals to Rs. 14 Crore

· Strong EBITDA/MT growth at Rs. 21,036 for Q3FY21 as against Rs. 15,754 in Q3FY20, up by 33.5% YoY basis

o Normalised EBITDA/MT excluding export incentives of Rs 14 Crore realized in Egypt, Stood at Rs 18,632 for Q3FY21

· PAT stood at Rs. 85.2 Cr for Q3FY21 as against Rs. 48.0 Cr in Q3FY20 up by % YoY

9MFY21 Performance

· Total volumes stood at 1,73,157 MT for 9MFY21 as against 1,66,107 MT in 9MFY20, up by 4.2% YoY

o ROW markets de-grew by 10.1% due to Specialty Care Products

o Robust Performance by Indian market with a 13.2% growth

o AMET market grew by 6.3% due to recovery in the Egypt market

o Performance Surfactants volume stood at 1,14,441 MT for 9MFY21, up by 9.3% on YoY basis

o Specialty Care Products volume stood at 58,716 MT for 9MFY21, down by 4.4% on YoY basis

· EBITDA for 9MFY21 stood at Rs. 339.7 Cr as against Rs. 272.2 Cr in 9MFY20, up by 24.8% YoY basis

· Strong EBITDA/MT growth at Rs. 19,620 for 9MFY21 as against Rs. 16,387 in 9MFY20, up by 19.7% YoY basis

· PAT stood at Rs. 223.5 Cr for 9MFY21 as against Rs. 167.6 Cr in 9MFY20 up by 33.3% YoY basis

About Galaxy Surfactants Limited: Incorporated in 1986, Galaxy Surfactants Ltd is leading manufacturers of Performance Surfactants and Specialty Care products with over 205 product grades. These products are used in consumer-centric Home and Personal care products like hair care, oral care, skin care, cosmetics, soap, shampoo, lotion, detergent, cleaning products etc.

Preferred suppliers to leading MNC’s, Regional and Local FMCG brands. Our key customers include Unilever, Reckitt Benckiser, P&G, L’OREAL, Himalaya, Colgate Palmolive, CavinKare etc.

Company has its manufacturing facilities located in India (5), Egypt (1) and USA (1).

For more information about the company, please visit our website www.galaxysurfactants.com

Safe Harbor: Statements in this document relating to future status, events, or circumstances, including but not limited to statements about plans and objectives, the progress and results of research and development, potential project characteristics, project potential and target dates for project related issues are forward-looking statements based on estimates and the anticipated effects of future events on current and developing circumstances. Such statements are subject to numerous risks and uncertainties and are not necessarily predictive of future results. Actual results may differ materially from those anticipated in the forward-looking statements. The company assumes no obligation to update forward-looking statements to reflect actual results changed assumptions or other factors.ends

Be the first to comment on "Galaxy Surfactants Ltd reports income of Rs 677.74 Cr in Q3 FY’21 witnessing a growth of 77.60% on YoY basis"